Get This Report on Hsmb Advisory Llc

Table of ContentsFascination About Hsmb Advisory LlcHsmb Advisory Llc Fundamentals ExplainedSome Ideas on Hsmb Advisory Llc You Need To KnowHsmb Advisory Llc Things To Know Before You Get ThisGetting The Hsmb Advisory Llc To Work

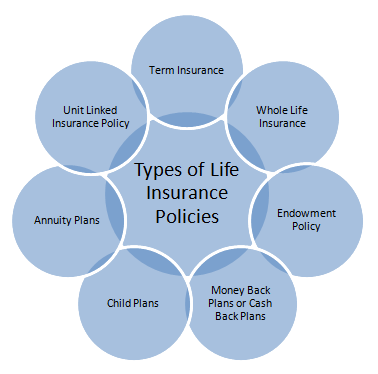

A variation, called indexed universal life insurance policy, provides an insurance policy holder the option to divide cash money worth amounts to a taken care of account (low-risk investments that will not be influenced by the stock exchange) or an equity indexed account, such as Nasdaq 100 or the S & P 500. https://hsmbadvisory.wordpress.com/2024/02/26/unlocking-peace-of-mind-health-insurance-in-st-petersburg-fl/. The insurance holder has the selection of how much to assign to every accountThese policies are called joint or survivorship life insurance and can be either first-to-die or second-to-die plans. A first-to-die joint life insurance coverage policy implies that the life insurance is paid out after the first individual passes away.

These are normally utilized in estate planning so there suffices cash to pay estate taxes and various other costs after the death of both partners. Let's claim John and Mary took out a joint second-to-die plan. So among them is dead, the policy is still energetic and doesn't pay.

The Facts About Hsmb Advisory Llc Revealed

This guarantees your lending institution is paid the equilibrium of your home loan if you pass away. Reliant life insurance policy is insurance coverage that is supplied if a spouse or reliant kid passes away. This sort of protection is normally utilized to off-set expenses that take place after death, so the amount is commonly little.

An Unbiased View of Hsmb Advisory Llc

This kind of insurance is additionally called funeral insurance policy. While it might appear odd to secure life insurance policy for this sort of activity, funeralseven simple onescan have a cost tag of numerous thousand bucks by the time all prices are factored in. That's a lot to learn. Finding out that you need life insurance is the initial step.

We're here to aid you break via the clutter and learn even more about one of the most prominent kinds of life insurance policy, so you can choose what's best for you.

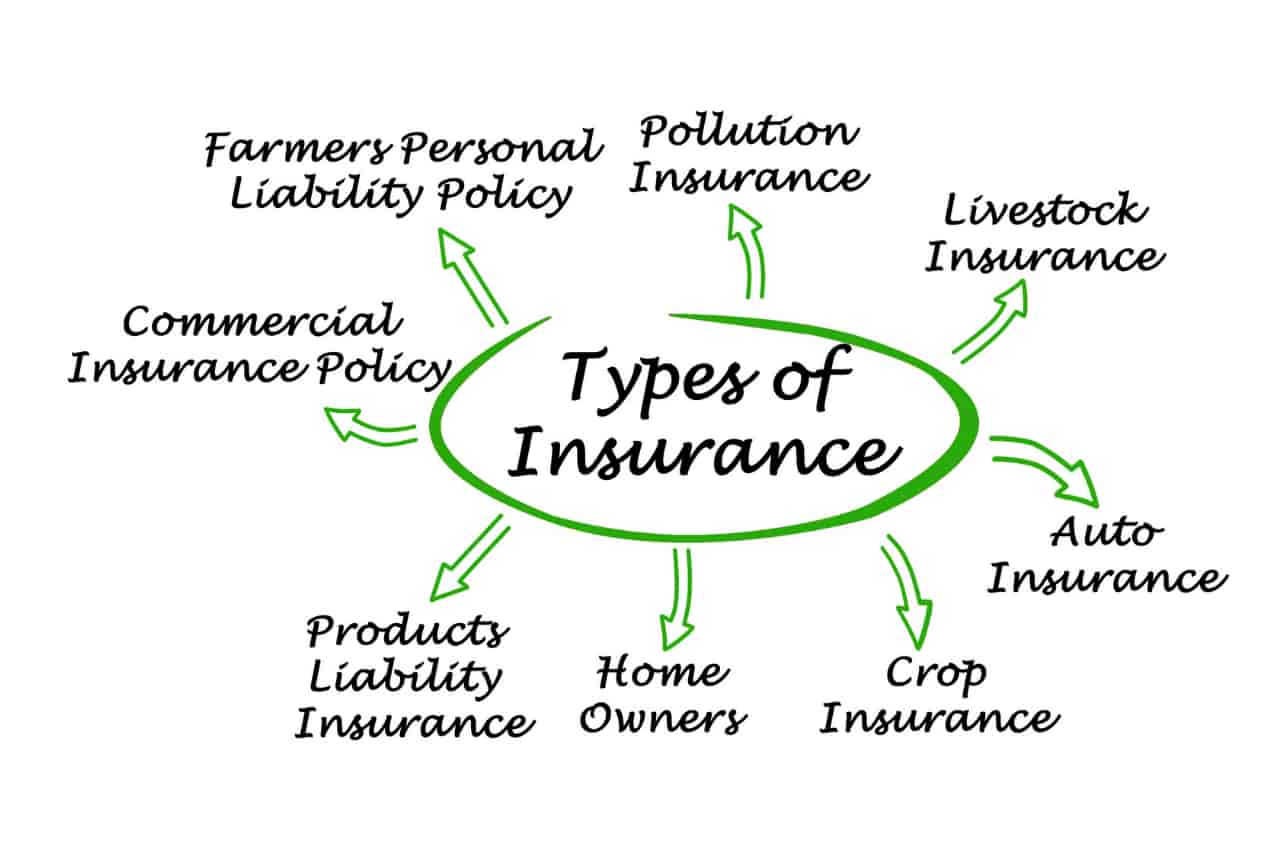

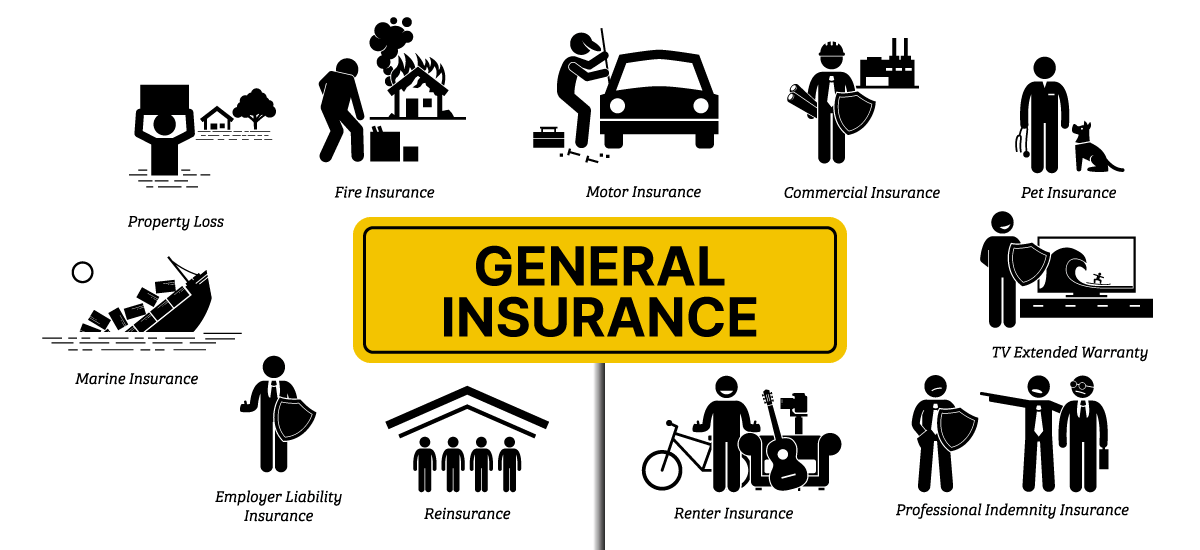

This web page offers a glossary of insurance coverage terms and interpretations that are frequently made use of in the insurance coverage organization. New terms will certainly be added to the reference over time. These interpretations represent a typical or basic usage of the term.

The Ultimate Guide To Hsmb Advisory Llc

- unanticipated injury to a person. - an insurance policy contract that pays a mentioned benefit in the occasion of death and/or dismemberment triggered by mishap or defined kinds of mishaps. - time period insured must sustain eligible clinical expenditures a minimum of equal to the insurance deductible amount in order to establish a benefit duration under a significant clinical expenditure or comprehensive medical cost policy.

- insurer possessions which can be valued and consisted of on the equilibrium sheet to determine financial stability of the firm. - an insurer certified to do business in a state(s), domiciled in an alternate state or nation. - occur when a policy has actually been refined, and the costs has actually been paid before the reliable day.

- the social sensation wherein individuals with a more than ordinary chance of loss seek better insurance policy protection than those with much less danger. - a group sustained by participant firms whose feature is to collect loss data and release trended loss prices. - an individual or entity that directly, or indirectly, through one or more other individuals or entities, controls, is managed by or is under common control with the insurer.

The Only Guide to Hsmb Advisory Llc

- the maximum buck amount or complete amount of insurance coverage payable for a single loss, or numerous losses, during a plan period, or on a solitary job. - method of repayment of a health insurance plan with a business entity that directly gives care, where (1) the health insurance is contractually required to pay the overall operating costs of the company entity, less any kind of earnings to the entity from various other individuals of solutions, and (2) there are shared endless assurances of solvency between the entity and the health insurance that placed their particular funding and surplus at risk in guaranteeing each other.

- an estimate of the insurance claims negotiation connected with a certain case or insurance claims. - an insurer developed according to the regulations of an international country. The business needs to comply with state regulative criteria to legally offer insurance policy products in that state. - protections which are usually created with building insurance, e.- an annual report needed to be submitted with each state in which an insurance provider does service. https://www.cheaperseeker.com/u/hsmbadvisory. This record offers a photo of the financial condition our website of a firm and significant events which took place throughout the reporting year. - the beneficiary of an annuity repayment, or individual during whose life and annuity is payable.